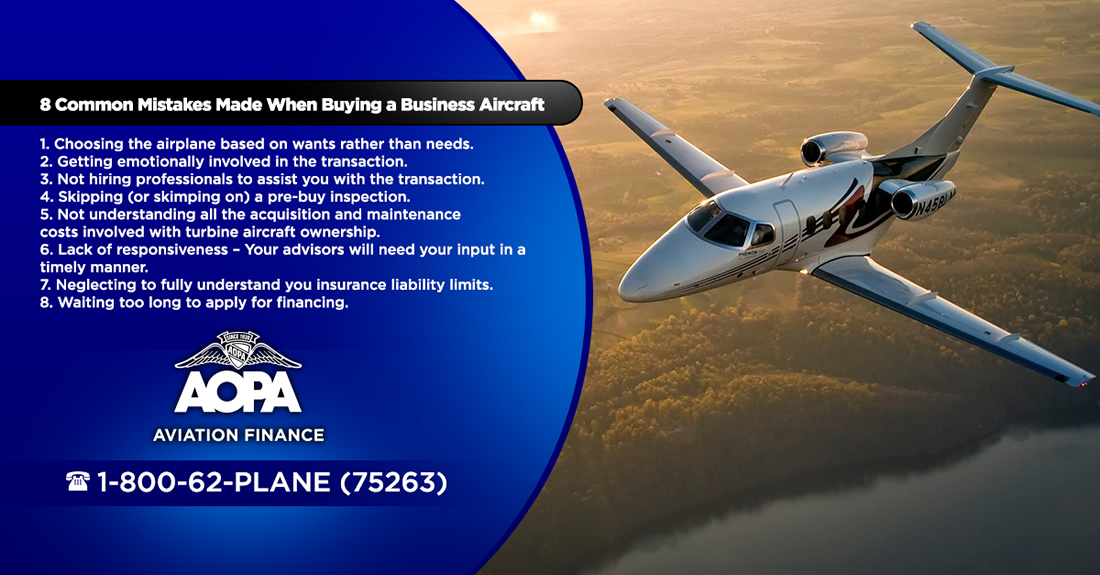

8 Common Mistakes Made When Buying a Business Aircraft

27th August 2015

By AOPA Finance Team

Purchasing a business aircraft can be daunting and costly, especially if you overlook the basics and make one of these common mistakes.

Mistake No. 1: Choosing the airplane based on wants rather than needs

When purchasing any aircraft understanding the most typical mission profile is critical. While you might want a Citation X because of its speed, size, range and relatively reasonable acquisition cost. You don’t need one if you plan on mostly flying regional trips of less than 600 nm with only 2-3 others. A new TBM or PC-12 would only have a block time difference of less than 20 minutes, have sufficient space and useful load, plenty of range and cost much less on an hourly basis and in maintenance.

Mistake No. 2: Getting emotionally involved in the transaction

You (or your spouse) happen to really like the paint scheme and interior of a particular aircraft. However, when going through the pre-buy inspection you realize there’s been a quite a bit of deferred maintenance. You could be tempted to just simply deduct that from the purchase price, but you should be considering another aircraft. It’s a lot less painful to have a well maintained aircraft get it repainted and re-ragged than it is to hear complaints about why the plane is not available and always in for repairs.

Mistake No. 3: Not hiring a professional to assist you with the transaction

When purchasing a turbine aircraft it may feel like everyone has their hand out looking for a fee. Carefully consider though, the value of expert counsel. There’s no need to pay Uncle Sam any more than you already have, a good aviation tax attorney will save you more than his/her fees. Likewise, if you are purchasing an aircraft with cash and not required to close through an Escrow agent, it might seem a good way to save a few thousand dollars. However, it is not uncommon to discover unpaid liens or other “clouds” on the title that will follow the plane and eventually be your issue to deal with – meaning you will likely have to either pay to settle the old claim or pay someone to defend against it. Additionally, you might be tempted to call your Financial Advisor or Banker at one of the large financial institutions and have him/her arrange financing. Who else knows your financial situation better? Instead, you would be well served to reach out to an aircraft finance broker that has relationships with multiple lenders and understands which institutions are most eager for your business. They can quickly look at your financial situation, you aircraft choice and you usage and then find you the most competitive option out there.

Mistake No. 4: Skipping (or skimping on) a pre-buy inspection

You’ve found the perfect plane, it’s been owned and managed since new by a fortune 500 company with an extensive flight department. It’s priced to sell and the seller’s aircraft broker is telling you they have multiple interested parties. You’re encouraged to put your best foot forward in the offer. You might be tempted to skip on the pre-buy inspection or perhaps only require airworthy items be remedied as part of your letter of intent. You’ve been told this over and over, but don’t assume anything! The only way to truly understand what costs you will be inheriting when you make this purchase is through a thorough pre-buy. Also, don’t assume an item that isn’t required to be fixed in order to meet airworthy requirements, won’t be expensive to fix.

Mistake No. 5: Not understanding all the acquisition and maintenance costs involved with turbine aircraft ownership

Do your homework (or hire an Aviation Consultant) before doing your shopping. You or your business has owned a TBM 700 for years and you understand aircraft acquisition and maintenance costs. While no two planes are exactly alike, neither are the costs to maintain them. The hidden cost in that really low priced Falcon 10 is that you will be probably spending more to operate it per year than you did to buy it. Don’t assume simple percentages when trying to forecast operating expenses. Do the research to find out what the typical hourly cost of operations will be for your upcoming purchase.

Mistake No. 6: Lack of responsiveness – Your advisors will need your input in a timely manner

If you expect things to go smoothly and you don’t have the bandwidth to keep up with the numerous requests of information you are setting yourself up for disappointment at a minimum and potentially incurring more transactional costs. Delegate, delegate and delegate – have your CPA handle financial requests, have your mechanic coordinate obtaining aircraft details even contemplate having your admin oversee all of your designees. Time kills all deals and is money! If you are unable to keep up with requests it’s time to find others to assist you in the process and hold the seller and experts accountable to do what they say when they say they will. Don’t waste money on last minute travel reservations because you thought the plane would be out of pre-buy and ready to close by Friday morning, just in time for your first vacation or business trip.

Mistake No. 7: Neglecting to fully understand your insurance liability limits

Work with an expert insurance broker and fully understand your coverage limits. The last thing you need to be dealing with is undue financial burden in the event of an accident. Furthermore, if you intend to fly your aircraft to the Bahamas or Mexico, are you insured? It is bad enough losing money but worse if you lose money and the aircraft. Not only will you want to make sure you are covered, so too will your lender. Most loan documents will require proof of proper coverage, failing to comply could put you in default of your loan agreement.

Mistake No. 8: Waiting too long to apply for financing

Don’t wait until a week or two before closing to secure financing. Not only will your options be limited, you may find you are unable to get it done in time. Even if you’ve worked with a familiar finance broker and/or lender and they know your financial situation, you might not realize this latest acquisition needs to be made with an entirely new lender. Often times the best rate and terms or the amount being requested will require you to change lenders. The right finance broker can lock in rates now but have them adjusted down if rates drop just before closing.

If you are looking for advice on resources in your upcoming purchase, please don’t hesitate to contact AOPA Aviation Finance, even if financing isn’t something you’re contemplating. On an annual basis, we serve and assist in more airplane acquisitions than any other lender or broker.

When purchasing a new or used turbine aircraft it is always best to stay ahead of the plane!

AOPA Finance Team

Knowledgeable and friendly aircraft finance professionals you can trust to find the best terms for your financing needs. Our goal is to make aircraft ownership more affordable and accessible to pilots.